1. What’s happening with gold prices in Indonesia right now?

Let’s not sugarcoat it — gold prices in Indonesia have been anything but boring lately. The gold price forecast Indonesia watchers are keeping close tabs as mid-2025 brings relatively high values, driven by global uncertainty, inflation pressures, and shifting currency values. It’s not an all-out rally, but it’s far from flat.

The market’s sending mixed signals, and many are wondering whether this is a temporary spike or a sign of more growth ahead.

2. Gold price forecast Indonesia: What’s causing gold prices to move in 2025?

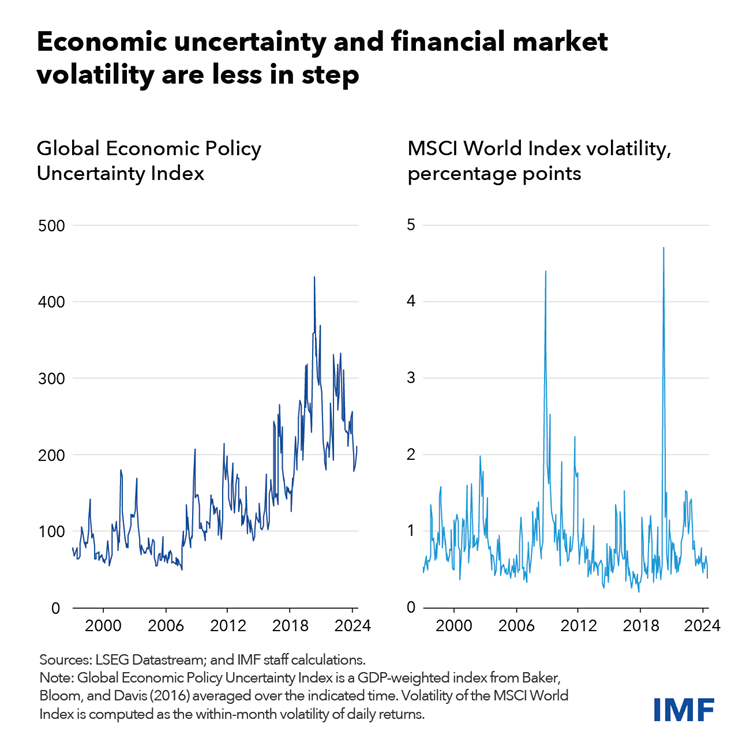

sources: How High Economic Uncertainty May Threaten Global Financial Stability

A few different factors — and not all of them are straightforward.

- Rupiah performance: When the rupiah weakens, local gold prices jump, even if global prices stay steady.

- Inflation: While easing in some regions, it’s still influencing investment decisions.

- Interest rates: Both global and local rate changes impact gold’s appeal.

- Geopolitical concerns: From global elections to regional instability, uncertainty pushes people toward safe-haven assets like gold.

Put simply: it’s a mix of economics, emotion, and political guesswork.

3. Gold price forecast Indonesia : What do experts say about the gold price forecast for Indonesia?

Forecasts for 2025 vary — not wildly, but enough to keep things interesting.

Some analysts expect prices to trend higher, potentially hitting Rp 1,300,000 to Rp 1,400,000 per gram, driven by demand from central banks and investor uncertainty.

Others suggest a more stable or slightly declining trend if interest rates go up again. In that case, prices may stay closer to Rp 1,100,000 to Rp 1,200,000.

In short: no one’s predicting a crash, but don’t expect a moonshot either.

4. Gold price forecast Indonesia: Is it a good time for Indonesians to invest in gold?

It depends on your investment style. If you’re in it for long-term value protection or to hedge against inflation, gold still makes sense.

For short-term speculation? Maybe not. Prices can stall or dip without warning, and premiums at retail outlets can eat into your profits.

Gold’s strength lies in stability, not quick wins. So if you’re looking for slow growth and peace of mind, it could be worth a spot in your portfolio.

5. How do global events influence gold prices in Indonesia?

In more ways than you might think.

- US rate changes? Gold reacts instantly.

- Political drama in Europe or Asia? Expect price movement.

- China or India ramping up gold buying? Global prices follow — and so does Indonesia.

- Oil prices or natural disasters? Oddly enough, those too can affect the market.

It’s a globally connected game, but it lands right in the local shops and investment apps of Indonesians.

6. Where can Indonesians track real-time gold prices?

Good question — because accuracy matters when prices shift daily.

- Logam Mulia (Antam): The go-to for daily updates on certified gold bars.

- Pegadaian Digital: Convenient for tracking and buying.

- Tokopedia Emas / Shopee Emas: Surprisingly useful for mobile users.

- Bareksa, Pluang, or IndoGold: Great for app-based investing.

- Financial news sites like CNBC Indonesia or Kontan: Solid for bigger-picture insights.

Stay away from outdated blogs or random social media posts — prices move too fast for guesswork.

7. Will gold prices keep climbing through the rest of 2025?

Hard to say for sure — but modest growth seems to be the consensus.

Most forecasts don’t point to a massive rally or a crash. The gold price forecast Indonesia is leaning toward slow gains, maybe a few dips, but generally staying strong. A cautious but steady market — that’s the vibe for now.

If you’re investing, think more in years than months. Gold still holds its shine — just don’t expect fireworks every week.