It’s 2025, and Ethereum vs Bitcoin Singapore, the crypto scene has matured. It’s quieter now. Less buzzword-y, more grounded. That’s probably why the shift between Ethereum and Bitcoin hasn’t made headlines. Even so, it’s happening.

Ethereum isn’t just another token anymore. Instead, here in this city, it’s becoming the infrastructure. Not a theory. Not a trend. Rather, it’s just—there. Underneath things. People are building on it, regulators are exploring it, and yes, even banks are testing it. Bitcoin? It’s still around, obviously. Still important. Just… not the center of gravity it once was.

Ethereum vs Bitcoin Singapore: A Shift in Utility, Not Sentiment

Don’t get me wrong—people still love Bitcoin. In many ways, it remains symbolic. It’s safe, simple, solid. You hold it and wait. But Ethereum? On the other hand, you use it.

A startup building tokenized carbon credits? On Ethereum.

An art collective minting NFTs? Ethereum.

MAS doing experiments with programmable finance? Guess what—Ethereum again.

It’s not that Bitcoin is failing. Rather, Ethereum simply fits better. Especially here.

The Merge Didn’t Just Lower Energy Use—It Opened Doors

Created By consultancy

Back when Ethereum switched to proof-of-stake in 2022, most people called it a technical upgrade. Over time, though, the conversation shifted. In Singapore’s ESG-obsessed finance world, it changed everything.

Today, in 2025, that decision is one of the main reasons institutional money feels okay touching crypto again. ESG reporting is serious here. No CFO wants to justify holding an asset that burns energy like a data center. Consequently, Ethereum’s energy profile? A huge win. Meanwhile, Bitcoin—fair or not—can’t really match that reputation.

Project Guardian Isn’t About Crypto Hype—It’s Infrastructure Testing

Created By fintechnews

Here’s the part that often gets overlooked: MAS’s Project Guardian isn’t about endorsing crypto. Instead, it’s about exploring rails for future finance. Tokenization, real-world asset flows, DeFi protocols. And when those experiments get built, it’s usually on Ethereum-compatible chains.

It makes sense. Ethereum lets you write logic into money. That’s exactly what Singapore regulators need—not just store-of-value assets, but programmable infrastructure they can test, control, pause, audit. Bitcoin, brilliant as it is, just wasn’t designed for that.

Ethereum vs Bitcoin Singapore: Crypto Feels Less Wild, More Boring—In a Good Way

Created By aapanel

I spent an afternoon at a Web3 coworking space in Telok Ayer last week. No hype. No moon charts. Just builders. Designers. Backend people. I asked five of them what they were building on. Four said Ethereum. One said Solana (and then said, “I know, I know”).

It wasn’t a tribal thing. Rather, it was practical.

Ethereum is what most wallets support. What investors understand. What open-source tooling exists for. By now, that counts for more than passion.

The Tokenization Train Has Left the Station—and It’s on ETH Rails

Whether it’s carbon credits, real estate, invoice factoring, or treasury notes—tokenization in Singapore is no longer a theory. In fact, it’s active. And guess which protocol keeps showing up in pilot decks?

It’s not always “Ethereum mainnet” per se. Sometimes it’s L2s. Sometimes it’s private forks. Still, the standards, the logic, the rails—remain Ethereum.

And that familiarity matters. Especially in a system as compliance-heavy and detail-obsessed as Singapore’s.

So… Is Ethereum “Winning” in Singapore?

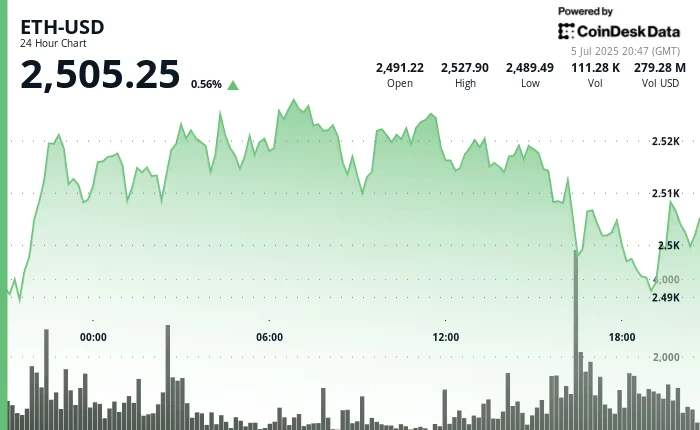

Created By coindesk

That depends on what you mean by “winning.”

Price-wise? Depends on the week.

Cultural relevance? Probably still Bitcoin.

But infrastructure, usage, compatibility with finance, policy, regulation?

That’s where Ethereum shines. And maybe that’s why—despite fewer headlines and lower Twitter volume—Ethereum is outperforming Bitcoin in Singapore in 2025. Not loudly. Not dramatically. But definitely.