Introduction: Gold in 2025 — Questions Every Vietnamese Investor Is Asking

With inflation still looming and global markets in flux, Vietnamese investors are paying close attention to the 2025 gold forecast. Is this the time to hold, sell, or buy more? In this FAQ, we explore key questions surrounding Vietnam’s gold market outlook for the year ahead — without the hype.

1. Will gold prices rise or fall in Vietnam in 2025?

Credit from AInvest

The outlook is mixed. Some experts believe gold could hold steady or climb if inflation remains persistent. However, if inflation stabilizes and interest rates drop globally, gold could cool slightly. The most likely scenario? A moderate, stable price range — rather than a steep climb or sudden crash.

2. What is the connection between gold and inflation in Vietnam?

Credit from Emerald Insight

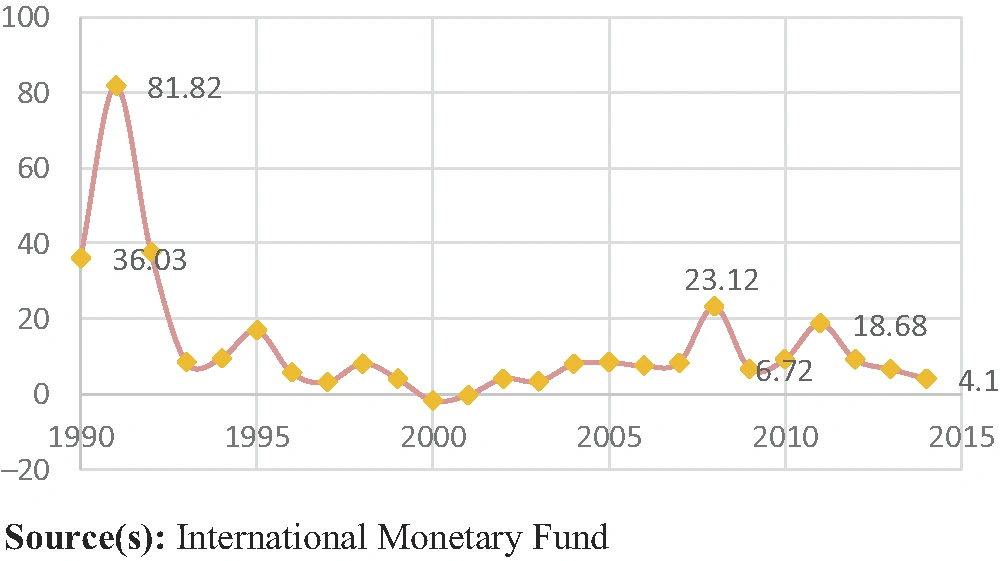

Gold vs inflation has long been a key relationship. In Vietnam, as in other markets, gold is often viewed as a hedge when the cost of living rises. If inflation accelerates again in 2025 — due to fuel prices, currency shifts, or food costs — local demand for gold could increase, supporting higher prices.

3. Will gold crash in 2025?

A full gold crash in 2025 is unlikely in Vietnam’s case. Unlike speculative-heavy markets, Vietnam’s gold buyers are mostly long-term holders who purchase for wealth preservation and cultural reasons. While a small correction in price is possible, there are no strong signals pointing to a major collapse.

4. What is the 2025 gold price prediction for Vietnamese investors?

While no one can predict the future with certainty, analysts expect the Vietnam gold price in 2025 to stay within a cautious upward range — with prices moving slightly based on inflation, global interest rates, and demand cycles like the Tet holiday. Most forecasts suggest prices could remain 5–10% above 2023–2024 averages.

5. Should you buy gold in Vietnam before 2025?

That depends on your goals. If you’re looking for long-term protection of savings, gold remains a stable store of value. However, those seeking fast returns might consider waiting until early 2025 to gauge inflation and currency movements. Timing around key cultural spending periods may also impact pricing.

6. What factors will influence gold prices in Vietnam in 2025?

Several local and international factors will shape Vietnam’s gold market:

- Inflation levels in Vietnam and major economies

- USD exchange rates and central bank policies

- Domestic buying behavior, especially during wedding season and Tet

- Government policies on gold import/export or pricing caps

- Global uncertainty, including geopolitical or economic events

These factors can shift investor confidence and create both short-term spikes and long-term trends.

7. Is gold still a safe investment in Vietnam in 2025?

Yes — especially for conservative investors. Gold continues to offer liquidity, cultural value, and inflation protection. It may not outperform stocks or tech investments, but its role as a financial anchor remains strong in Vietnamese households, particularly during economic transitions.

8. How does Vietnam’s gold market differ from others?

Vietnam’s market is heavily rooted in physical gold — jewelry, bars, and coins — rather than paper-based or digital assets. Pricing often reflects local demand, government policy, and supply limitations, meaning it can behave differently from international markets. This makes the Vietnamese gold market more stable, but also more sensitive to domestic trends.

Conclusion: A Cautious but Stable 2025 Outlook

Credit from bne IntelliNews

The 2025 gold forecast for Vietnam suggests stability, not sensationalism. While there’s no guarantee against dips, most signs point to a balanced year — not a boom, and not a bust. For Vietnamese investors, the focus in 2025 may shift from speculation to preservation — a quiet return to gold’s traditional role in times of change.