MACD RSI for Forex Indonesia: For many traders in Indonesia, reading the forex market is about more than reacting to price shifts — it’s about understanding the signals that come before those moves. Technical indicators offer a structured, visual way to decode market behavior. In particular, the pairing of MACD RSI for Forex Indonesia has gained traction due to its reliability and simplicity. These tools help traders cut through distractions, giving them a chance to analyze momentum and trend strength without relying on emotion. In an economy like Indonesia’s, where exchange rates can fluctuate based on both global cues and domestic policy shifts, indicators are like a trader’s compass — offering direction when markets feel uncertain or reactive.

MACD RSI for Forex Indonesia: What Is MACD and Why Do Indonesian Traders Use It?

The MACD, short for Moving Average Convergence Divergence, is a trend-following indicator that focuses on price momentum. It’s calculated using two exponential moving averages and a signal line that traders watch for crossovers — a moment that often marks a change in market sentiment. In the Indonesian context, MACD becomes especially useful during times of policy announcements, export price changes, or shifts in international sentiment toward emerging markets. A bullish crossover might indicate a buying opportunity if supported by broader market conditions, while a bearish crossover can suggest fading momentum. Indonesian traders often turn to MACD when they want to validate whether a breakout is likely to continue — particularly during sessions when trading volume rises due to overlapping global markets.

MACD RSI for Forex Indonesia: How Does RSI Support Trade Decisions in Indonesia?

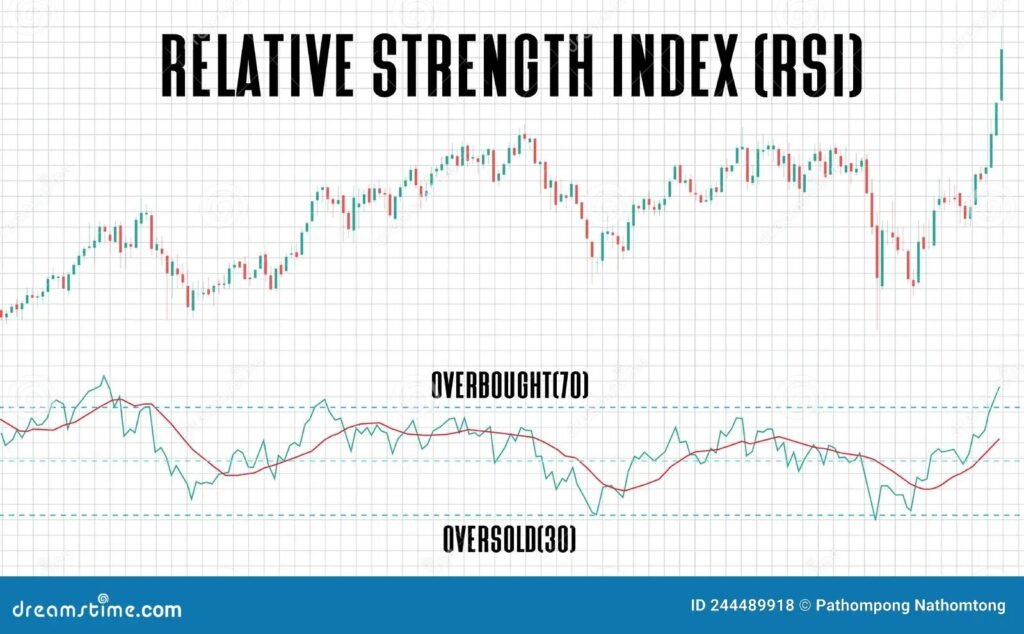

Source: dreamstime

The Relative Strength Index (RSI) is a popular oscillator that measures how quickly price moves and whether a currency pair may be overbought or oversold. With a scale ranging from 0 to 100, RSI helps Indonesian traders slow down and reassess when a price spike might seem too good — or too bad — to be true. When RSI climbs above 70, it often signals that buying pressure is peaking; when it drops below 30, it can suggest a market is oversold. In Indonesia’s forex space, where sudden swings can be triggered by changes in energy prices or domestic policy statements, RSI gives traders a chance to pause and look beyond the headline. This makes it especially valuable in avoiding emotionally driven trades, providing a calm, data-backed snapshot of momentum.

MACD RSI for Forex Indonesia: How Do MACD and RSI Work Better When Combined?

One of the reasons MACD RSI for Forex Indonesia is such a popular pairing is because these tools offer different but complementary views of the market. MACD focuses on the strength and direction of a trend, while RSI offers insights into the pace of recent price changes. Used together, they create a more complete technical picture. For example, MACD might show that a bullish trend is starting to form, but if RSI is already in overbought territory, traders may choose to wait for a retracement. On the flip side, if MACD turns negative but RSI remains neutral, it could mean the trend lacks conviction. Indonesian traders benefit from this combination by avoiding hasty decisions. It allows them to filter out noise and act only when multiple indicators support the trade idea.

What Value Do Bollinger Bands Add in Indonesia’s Market Setting?

Source: okx

Bollinger Bands are volatility-based indicators that frame the current price between an upper and lower band, with a middle line representing the moving average. These bands stretch and contract depending on recent price volatility. For traders in Indonesia — where currency moves can be driven by sudden capital inflows, regional market sentiment, or central bank updates — Bollinger Bands are useful for spotting extreme conditions. A price that presses repeatedly against the upper band could be in a strong uptrend, but if combined with an RSI over 70, traders may start watching for a reversal. Likewise, a Bollinger Band “squeeze” can suggest a breakout is coming — especially if supported by a MACD crossover. This visual tool, when used with momentum indicators, adds context to price movement in volatile sessions.

Are Moving Averages Still Relevant for Trend Analysis in Indonesia?

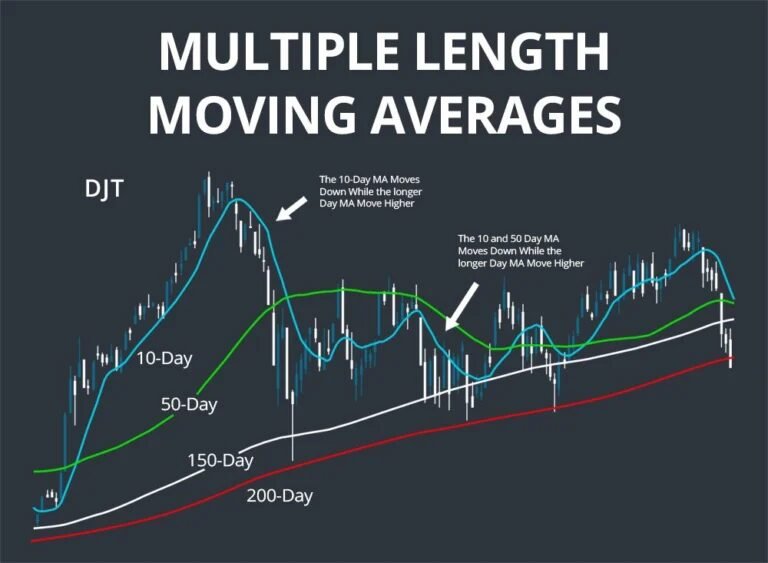

Source: SCANZ

Moving averages, both simple and exponential, are still among the most dependable indicators for Indonesian forex traders. Their role is to smooth out short-term fluctuations and reveal longer-term trends — an especially valuable function in a market that often swings between calm periods and sudden volatility. Indonesian traders often watch for moving average crossovers — such as a 10-day EMA crossing above a 50-day EMA — to confirm directional bias. When this aligns with a MACD bullish crossover or an RSI value climbing above 50, confidence in the trade idea increases. Moving averages also help identify areas of dynamic support and resistance, making them a key part of many Indonesian traders’ strategies, whether they’re looking at the USD/IDR or more globally traded currency pairs.

How Do Stochastic Oscillators Fit into Indonesia’s Forex Strategies?

The stochastic oscillator compares a current closing price with the range over a recent period and is often used to pinpoint when a currency pair might be reversing. It’s a favored tool among Indonesian short-term traders, especially those active during high-volume hours like the overlap between the European and Asian sessions. The oscillator produces two lines that traders watch for crossovers, particularly in overbought or oversold zones. A crossover above 80, for instance, can signal that bullish momentum is weakening. When that aligns with a flattening MACD or a turning RSI, it might be a sign to exit a long position. For Indonesian traders looking for tighter entries and exits — especially during reactive news periods or post-data release surges — stochastic indicators offer one more layer of precision.

What Are the Pitfalls of Relying Too Much on Indicators?

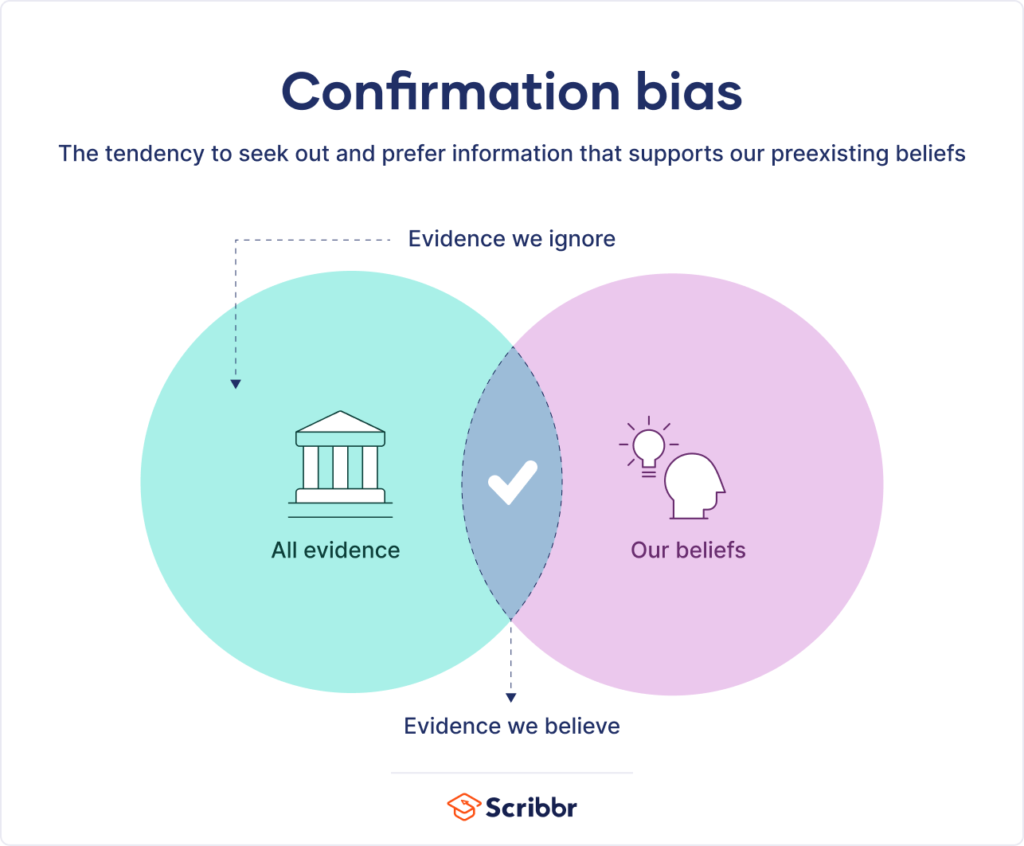

Source: Scibbr

While tools like MACD and RSI offer structure and clarity, they are not infallible. One of the most common mistakes among Indonesian traders is relying solely on one signal — for instance, acting on a MACD crossover without checking broader market sentiment or confirming with other indicators. Another issue is using indicators without understanding the market context. Technical setups might suggest a breakout, but if it happens during low liquidity hours or against the backdrop of major global uncertainty, the setup might not hold. It’s also easy to fall into the trap of confirmation bias — seeing what one wants to see in the indicators instead of reading them objectively. The most effective use of MACD RSI for Forex Indonesia comes when they’re part of a disciplined, broader strategy that incorporates risk management, chart awareness, and an eye on economic news.

Why Do MACD and RSI Still Stand Out in 2025?

Even as trading platforms evolve and new tools emerge, MACD RSI for Forex Indonesia continue to hold their place as trusted indicators. Their longevity speaks to their effectiveness. In 2025, these tools remain relevant because they’re adaptable — working across timeframes, currencies, and market conditions. Indonesian traders value them not just for their simplicity, but for how they help build confidence through confirmation. Whether used alone or paired with moving averages, Bollinger Bands, or stochastic signals, MACD and RSI remain central to how many in the local trading community approach the market. In an era of fast information and reactive sentiment, having tools that cut through the noise is more important than ever — and these two indicators continue to do just that.