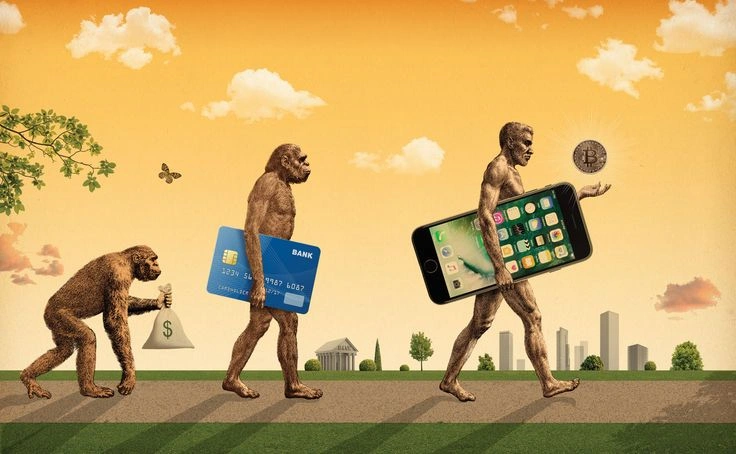

2025 crypto card trend: Back in the early days of crypto, most investors clung tightly to their Bitcoin, praying for a distant “moonshot.” Fast-forward to 2025, and the atmosphere has shifted dramatically. Instead of hoarding digital assets and riding out the market’s wild swings, a growing number of users are embracing a new habit: swiping their crypto cards for everyday purchases.

It’s quicker, smoother, and to many, a lot cooler. Gone are the days of complicated sell-offs and banking transfers. Instead, buying a coffee or paying for a grocery run now feels as natural as tapping a debit card — because it is.

Of course, not everyone has abandoned the old ways. Some still prefer to cash out their Bitcoin into traditional dollars or euros when needed. But when you look around, especially at younger investors and longtime early adopters, a quiet revolution is taking place: the crypto debit card is becoming the go-to move.

Crypto Cards in 2025: From Gimmick to Daily Essential

A few years ago, crypto cards were met with skepticism. They sounded flashy, perhaps even gimmicky — weighed down by clunky fees, confusing processes, and limited acceptance.

But those hurdles have faded into the background. In 2025, big players like Coinbase, Binance, and newer fintech brands have refined the experience. Users can now simply tap their card at the grocery store, pay for a Netflix subscription, or grab a latte — with crypto auto-converting into fiat behind the scenes.

There’s no longer a need to overthink the process. One swipe, and it’s done. Crypto spending has never felt more natural — or more invisible.

2025 crypto card trend: Why 2025? The Perfect Timing for a Crypto Card Surge

It’s fair to ask why crypto cards are booming now, instead of during the hype years of 2020 or 2021.

Back then, the idea of spending Bitcoin felt risky. What if Bitcoin’s price skyrocketed the day after you splurged on a sandwich?

Today, with the rise of stablecoins and a broader cultural acceptance of crypto, the fear factor has diminished. Stablecoins pegged to the dollar bring predictability, and a wider embrace of digital assets across industries makes spending feel far less nerve-wracking.

Convenience is the key driver. Few users have the patience to jump through complicated steps to liquidate a bit of ETH just for a quick lunch. Crypto cards cut out the middleman — and that frictionless experience is what’s winning people over.

Skeptics still exist. Some argue that crypto should be held or cashed out, not spent. But as more people swipe without a second thought, it’s clear that convenience — once again — is tipping the scales.

2025 crypto card trend: A Few Cautions Along the Way

As with any financial tool, crypto cards aren’t without their quirks.

Hidden fees still sneak into the fine print. Some cards impose network charges, exchange rate spreads, or maintenance costs that feel frustratingly similar to old-school banking annoyances.

Regulatory gray areas also persist, depending on the country. And for those who spend frequently, the headache of tracking taxable transactions can turn into a paperwork nightmare come tax season.

Yet, despite these hiccups, many users agree: the freedom and ease of crypto card spending outweigh the downsides.

2025 crypto card trend: Swiping Toward the Future

Watching this shift unfold, it’s hard not to wonder if the 2025 crypto card trend represents something bigger: the beginning of crypto’s real-world normalization.

It may not replace traditional banking overnight. Those lofty dreams of total financial disruption have cooled. But if millions of people are effortlessly using Bitcoin or Ethereum to pay for their groceries, their coffee, or their next vacation — that’s no small victory.

Whether you’re still clutching your Bitcoin wallet or you’re already tapping your way through daily purchases, one thing is clear: the world of crypto spending is evolving fast. The real question is — are you ready to swipe into the future?

Relevant News: Here