So, You’re Thinking About Crypto?

Crypto trading is gaining ground among individual investors, but for beginner crypto trading enthusiasts, the market can appear confusing and fast-paced. From sudden price swings to unfamiliar terminology, it’s easy to feel out of place. Yet, for many first-time investors, the appeal lies in the accessibility and decentralization of crypto assets. If you’re new, don’t worry — a few smart steps can make the space more manageable.

First, Grasp the Basics

At its core, beginner crypto trading involves buying and selling digital currencies like Bitcoin, Ethereum, or others, using online platforms known as exchanges. It’s not unlike trading stocks — you watch the market, place buy or sell orders, and hope your timing is right. But unlike traditional markets, crypto trades 24/7 and tends to be much more volatile.

For those just getting started, the suggestion is simple: start small. Don’t let FOMO (fear of missing out) push you into risky decisions. A small investment into a major coin can be a smart way to begin learning how the system works.

Choosing the Right Platform for Beginner Crypto Trading

The choice of trading platform can make or break a beginner’s experience. Reputable exchanges such as Coinbase, Binance, or Kraken offer user-friendly interfaces, built-in wallets, and robust security systems. For beginner crypto traders, these platforms also provide educational tools, which can be invaluable early on.

Keep in mind: not all platforms are created equal. Some have better regulatory compliance, some lower fees, others offer more coin options. Look into each before committing, and don’t skip the identity verification (KYC) process — it adds a layer of security for all users.

Why Wallets Matter in Beginner Crypto Trading

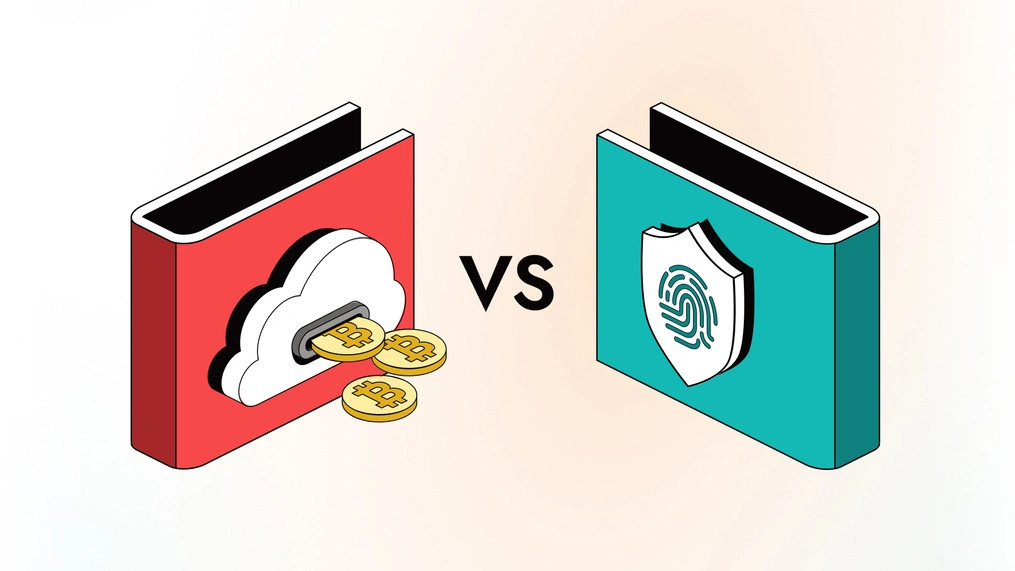

A wallet is essential for holding your crypto — and it comes in two main forms. Hot wallets (online) are easier to access and use, which makes them suitable for newcomers with small amounts of funds. But they come with higher risk due to potential cyber attacks.

On the other hand, cold wallets are offline and offer stronger protection. These physical devices or software solutions are less prone to hacking but are less convenient for frequent trading. Many beginners start with hot wallets and later migrate to cold wallets once their investments grow.

Starting Small, Learning Fast

One of the biggest beginner mistakes is trying to trade like a pro on day one. The crypto market can shift quickly, and hype-driven decisions often backfire. Instead, think of your first trades as tuition — a way to learn by doing, rather than expecting instant profit.

Beginner crypto trading is as much about developing discipline as it is about gaining knowledge. Study market trends, test small trades, and gradually build your confidence. Mistakes will happen — that’s part of the process.

Understanding the Risks in Beginner Crypto Trading

Risk management is often overlooked but absolutely essential. Crypto’s volatility means big swings — both up and down. It’s vital to set limits for yourself. For example, never invest more than you’re comfortable losing, and avoid reacting impulsively to market dips or surges.

Equally important is emotional control. Excitement can lead to overtrading, while panic can lead to premature exits. New traders often learn this the hard way — but those who maintain a calm, calculated approach tend to fare better long-term.

In Summary: Stay Informed, Stay Calm

Beginner crypto trading doesn’t have to be overwhelming — but it does require patience, self-control, and a willingness to keep learning. Take the time to research platforms, test wallet setups, and practice small trades.

There’s no guaranteed path to success in crypto, but with steady effort and awareness, you can avoid common traps and build real skill. Whether you stick to Bitcoin or explore altcoins down the line, the key is staying informed and staying calm in the face of the noise.

Relevant news: here