The New Wave of Traders: Why Is Day Trading Everywhere?

Day trading risks are becoming more visible as the practice shifts from a niche used by professionals to a trendy pursuit among younger generations. The idea of making quick profits by buying and selling stocks within the same day — sometimes within minutes — has become incredibly appealing. It’s fast, digital, and in the eyes of many beginners, a potential shortcut to financial independence.

Platforms like TikTok, YouTube, and Telegram groups are filled with stories of young traders who made a week’s salary in a day. In Vietnam, where mobile access to financial platforms is rapidly growing, day trading has become a trend, especially among Gen Z and young millennials. There’s a sense that anyone can try it. You don’t need to be rich, you just need a smartphone, a brokerage app, and a little courage.

But beneath the excitement lies a far less glamorous reality. Day trading risks are very real — and for many who enter unprepared, the experience ends in frustration or financial loss.

Day Trading Risks: What Exactly Is Day Trading?

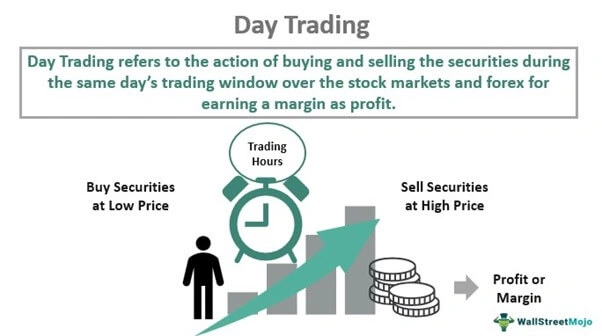

Credit from WallStreetMojo

Day trading refers to the practice of buying and selling financial assets within a single trading day. The most common instruments are stocks, but some traders also work with forex, cryptocurrencies, or derivatives. The goal is simple: take advantage of small price movements and profit quickly.

Unlike traditional investing, which focuses on long-term growth and often involves holding assets for months or years, day trading is all about speed. Positions are rarely held overnight. Everything happens in a tight window of time, and traders are constantly reacting to new information, price charts, and emotional pressure.

The pace is fast — and so are the stakes.

The Risks Lurking Beneath the Surface

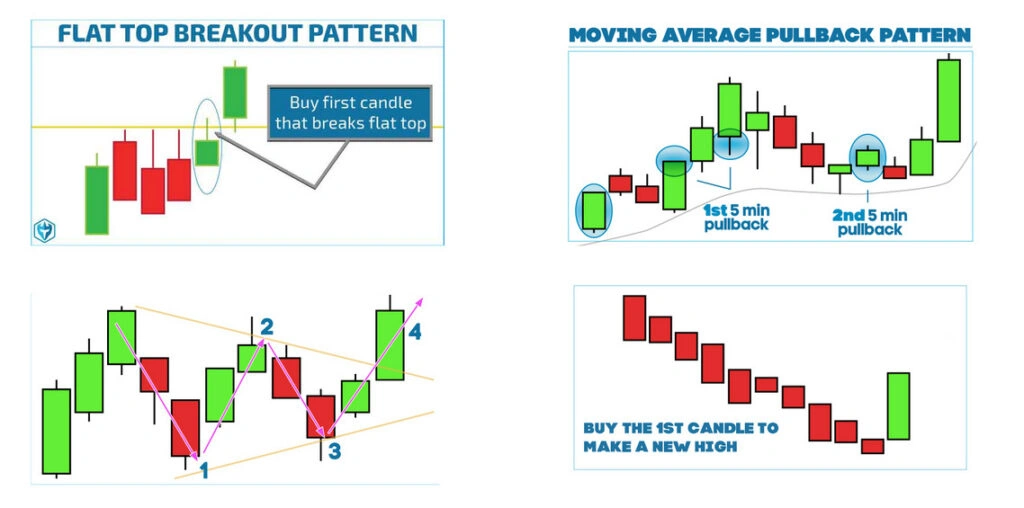

Credit from Warrior Trading

It’s important to understand that day trading is not just risky — it’s extremely risky, especially for beginners. Market volatility, emotional decision-making, lack of experience, and technical disadvantages all combine to create an environment where losing money is more likely than winning.

The most immediate danger is simple: losing capital. Because trades happen quickly, small mistakes can lead to big losses. A beginner might buy a stock that drops sharply minutes later, and without a clear exit plan, the situation worsens. Unlike long-term investing, there’s no “waiting it out.” Timing is everything.

Emotion also plays a large role. New traders often struggle to stay calm under pressure. After a loss, they may try to recover by entering another trade too quickly — what’s known as “revenge trading.” Others get overconfident after a small win and increase their trade size too early. In both cases, emotions take over logic.

There’s also the reality of the competition. Most new traders don’t realize that they are up against high-frequency trading (HFT) systems — computer algorithms that can place thousands of orders in milliseconds. These algorithms can detect patterns and react faster than any human. For beginners working alone on a mobile app, the playing field is far from level.

Then there are hidden costs: commissions, taxes, platform fees, and the mental toll of constant decision-making. These may seem small at first, but they add up over time and often eat into any short-term gains.

Day Trading Risks: Why, Then, Do People Still Do It?

Despite all of this, day trading remains wildly popular, and in some places — including Vietnam — it’s growing even faster. So why do people keep jumping in?

First, there’s the perception of control. Day trading gives people the feeling that they’re actively managing their money. Unlike passive investing, which can feel slow and disconnected, day trading offers constant feedback. You place a trade, and you know the outcome within minutes or hours. For some, that’s exciting and addictive.

Second, the success stories are everywhere. Social media algorithms tend to amplify dramatic wins. When someone posts a screenshot showing a 20% profit in one afternoon, it sparks interest. Others think, “If they can do it, maybe I can too.” Rarely do these posts show the losses, the months of study, or the trades that didn’t work out.

In Vietnam, the rise of digital banking and easy-to-use trading platforms has lowered the entry barrier even further. Many apps now allow users to create accounts within minutes, fund them using e-wallets, and place trades almost instantly. This speed and convenience make it easy to get started — but also easy to get burned.

The local cultural environment also plays a role. In a society that’s becoming more financially aware, but where traditional financial education is still limited, day trading feels like a shortcut. It’s a way to engage with money on your own terms. For students, freelancers, or young professionals who don’t yet have large savings, the idea of multiplying capital through trading can seem far more appealing than leaving money in a savings account.

Day Trading Risks: The Line Between Learning and Losing

Credit from UrbanAsian.com

There’s no doubt that day trading can be a powerful learning experience. Many seasoned investors say their early trading mistakes taught them more than any textbook. But the cost of those lessons can be high — and that’s the part beginners often overlook.

For those who are curious but cautious, starting with a demo account or a small amount of capital is one way to reduce risk. Some Vietnamese trading platforms even offer simulated markets where users can practice without using real money. This allows beginners to build experience, understand patterns, and develop discipline before putting their funds at stake.

Education also matters. Learning about risk management tools like stop-loss orders, setting trade limits, and identifying emotional triggers can go a long way. Watching the market and reading about basic technical analysis is more useful than simply copying tips from a Telegram group.

More importantly, beginners should understand the difference between day trading and investing. Investing is about building wealth over time through compounding and patience. It usually involves less stress and has more consistent long-term outcomes. Day trading, on the other hand, is speculative. It requires time, focus, and a strong tolerance for uncertainty.

The Vietnamese Context: A Growing But Cautious Audience

Vietnam’s financial markets are still developing, and with them, a new generation of investors is emerging. Young people are exploring different ways to grow their income, and technology has made markets more accessible than ever.

But the challenges are just as real. Financial literacy is still catching up. Many new traders rely on informal sources like social media, chat groups, or online rumors. Without a strong foundation, mistakes are common — and often expensive.

Regulators in Vietnam have begun issuing warnings about the risks of day trading and speculative behavior, especially among younger users. But with little enforcement and a fast-moving digital economy, the responsibility often falls on individuals to educate themselves.

That said, the trend is not all bad. A growing interest in markets can lead to better financial awareness over time. If new traders are given the right tools, knowledge, and support, they can become informed participants in the economy — not just gamblers chasing short-term gains.

Conclusion: Look Past the Hype, Focus on the Reality

There’s nothing wrong with being curious about day trading. The idea of making your own money, on your own terms, is powerful. But curiosity should be matched with caution. Day trading risks are not always obvious until it’s too late.

In Vietnam and elsewhere, this trend is likely to continue. But those who take the time to learn, observe, and manage risk wisely will stand a better chance of success — or at least, avoid the most painful mistakes.

Before jumping in, take a step back. Study the game before playing. Understand who the real players are — and what tools they use. Know your limits. And remember, in the world of day trading, sometimes doing nothing is the smartest move of all.