Let’s start with a simple truth—don’t all-in crypto. It might sound like a buzzkill, especially when headlines scream about overnight millionaires. But in a market as unpredictable as crypto, diving in headfirst without a plan isn’t brave—it’s reckless. If you’re new to the scene or still figuring out how this all works, this guide is for you.

Why “Don’t All-In Crypto” Is Rule #1 for New Investors

Crypto can be thrilling. It moves fast, it’s constantly evolving, and yes, people really have made life-changing money from it. But what you don’t always see is the other side—the losses, the crashes, the emotional stress.

When you all-in, you’re putting everything—your capital, your hopes, and often your emotions—into one volatile asset. That means if the market turns (and it does… often), you’re left with no safety net.

A more sustainable approach? Treat crypto like any other high-risk investment: balance it, diversify it, and don’t let hype cloud your judgment.

Timing the Market Is a Trap—Especially If You All-In

Many beginners believe they’ll “catch the wave”—that they’ll jump in at the perfect low and ride it to the top. In reality, that’s incredibly rare, even for professionals. The truth? Don’t all-in crypto if your strategy relies on perfect timing, because you’re likely to get burned.

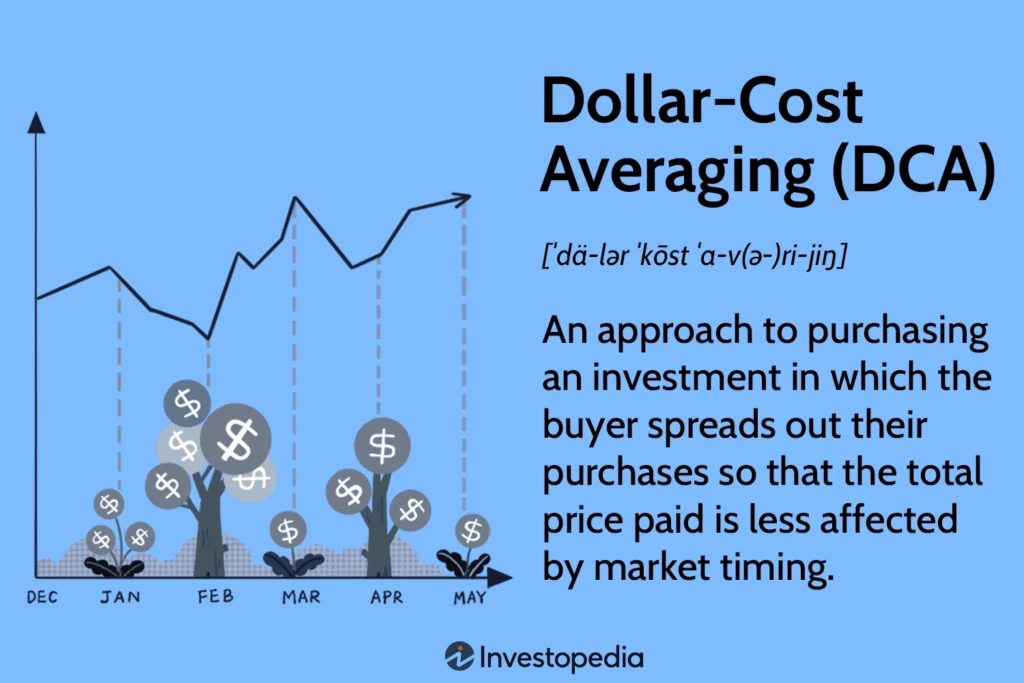

Instead, consider dollar-cost averaging (DCA)—investing smaller amounts at regular intervals. It’s not flashy, but it protects you from buying in at a peak and gives you better odds over time.

Diversification: It’s Not Boring, It’s Smart

Putting all your money into a single coin (or even one asset class like crypto) is risky. We’re talking full exposure to wild price swings, project failures, regulatory changes—you name it.

Diversification doesn’t mean spreading yourself thin. It means balancing your portfolio across different types of assets or coins with different risk profiles. That could mean mixing Bitcoin with a couple of solid altcoins and even keeping a portion in stablecoins.

And yes—don’t all-in crypto, but also don’t ignore it entirely. Just make sure it’s one part of a bigger financial picture, not the whole thing.

Emotions and All-In Investing Don’t Mix Well

Let’s be real: money is emotional. Especially when it’s your rent money, your savings, your “maybe this will change my life” bet. All-in investing turns normal price fluctuations into emotional rollercoasters.

One day you’re euphoric, the next you’re spiraling because your coin dropped 40%. That kind of pressure leads to rash decisions—panic selling, revenge buying, over-trading… the list goes on.

Keeping a cool head in crypto is tough—but giving yourself room to breathe by not going all-in makes it a whole lot easier.

Long-Term Mindset Beats Short-Term Hype

Some say crypto is about quick wins. But most of those wins are either exaggerated or unsustainable. If you really want to build wealth, you need a long-term view—one that includes losses, market cycles, and yes, patience.

A common phrase in traditional finance still applies here: “Time in the market beats timing the market.” And that’s even more true when you factor in the psychological toll of chasing highs.

Final Thoughts: Don’t All-In Crypto—Build, Learn, Grow

At the end of the day, don’t all-in crypto isn’t just a warning—it’s guidance. It’s a way to stay in the game, learn as you go, and protect your resources while you figure out what kind of investor you really are.

So take your time. Learn the tools. Follow the projects. Spread your bets. Crypto’s not going anywhere—but you might, if you all-in and lose it all.

Relevant news: here