What’s Behind the Rupiah Forecast 2025?

The Rupiah Forecast 2025 sits at the intersection of a changing global economic climate and Indonesia’s evolving domestic outlook. With the global economy still finding its footing post-pandemic, and major economies like the U.S. and China shifting gears, many currencies — especially in emerging markets — are being re-evaluated. For the Indonesian Rupiah, 2025 will likely bring heightened scrutiny from investors and policy analysts alike. A combination of macroeconomic fundamentals, central bank direction, and shifting global risk appetite will all weigh on the currency’s behavior. It’s not just about numbers — confidence, perception, and geopolitical headlines will also play a role in the way the Rupiah moves in the coming months.

What Risks Are Pressuring the Rupiah?

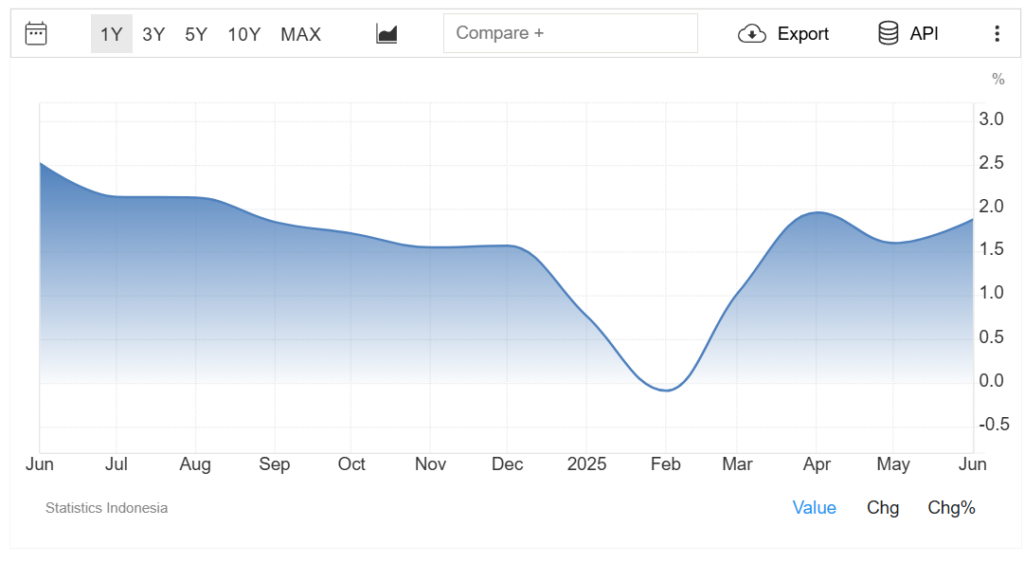

Source: TradingEconomics

There are no shortages of threats to the Rupiah forecast 2025, and many of them stem from outside Indonesia. The U.S. Federal Reserve’s policy path remains uncertain, and any delay in interest rate cuts could drive renewed strength in the U.S. dollar, putting downward pressure on the IDR. At the same time, capital outflows from emerging markets — driven by concerns over global growth, geopolitical conflict, or rising oil prices — could trigger currency volatility. Domestically, pressure points like fuel subsidies, fiscal deficit management, or trade imbalances could also invite investor caution. While these risks are not new, their convergence in a single year could magnify impact — making 2025 a critical test for the Rupiah’s resilience.

Could the Rupiah Appreciate Against the USD?

Source: Coincodex

There’s room for optimism, albeit cautious, when discussing whether the Rupiah will strengthen in 2025. If global economic uncertainty eases — for instance, if the Federal Reserve moves to cut rates or geopolitical tensions cool — risk appetite may improve, boosting flows to emerging markets like Indonesia. Locally, a narrowing trade deficit, steady inflation, and consistent economic growth could create the right conditions for the IDR to stabilize or even strengthen. Much will also depend on Bank Indonesia’s willingness to support the currency through measured interventions and monetary discipline. However, any appreciation is likely to be modest and uneven, given how sensitive the Rupiah remains to movements in the U.S. dollar and broader market sentiment.

What Role Does Indonesia’s Economy Play in This?

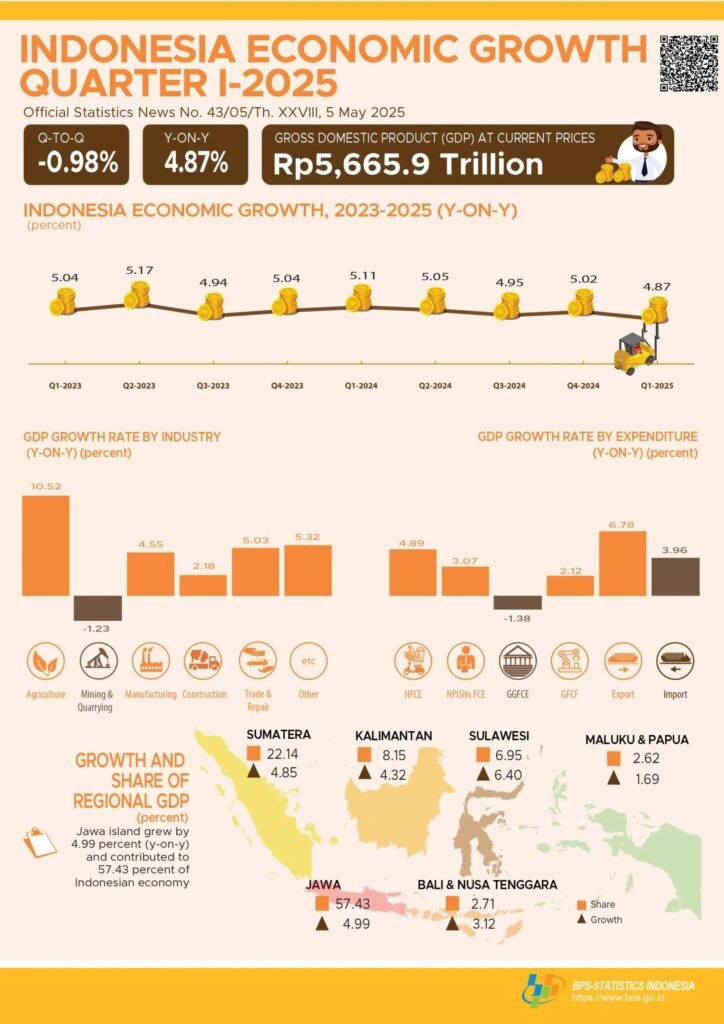

Source: BPS- Statistic Indonesia

Indonesia’s broader economic health is central to any meaningful Rupiah forecast. The country enters 2025 with a relatively strong macroeconomic foundation, including a growing middle class, digital sector expansion, and continued investment in infrastructure. However, global linkages — particularly in trade — remain critical. As a major exporter of commodities, Indonesia’s economy is tightly tied to global demand and price cycles. If commodity prices hold steady and regional trade relationships remain strong, that could offer tailwinds for the Rupiah. But if global demand weakens or export growth slows, the IDR could be left exposed. It’s a reminder that while domestic strength is vital, Indonesia’s economy doesn’t operate in a vacuum.

What Is Bank Indonesia Likely to Do in 2025?

Source: ANTARANEWS

The Bank Indonesia currency forecast 2025 will depend on how the central bank responds to inflation trends, capital flows, and external shocks. In recent years, Bank Indonesia has demonstrated a steady hand, intervening when needed to manage excessive volatility while remaining focused on inflation control. Entering 2025, inflation appears contained, but the possibility of global instability means Bank Indonesia may stay cautious. Policy flexibility — both in terms of rates and FX intervention — will be critical in navigating the year ahead. Investors will also be watching how the central bank communicates its intentions. A clear and credible message can do much to stabilize expectations, even when markets are jittery.

What Global Trends Should Investors Pay Attention To?

The Rupiah forecast 2025 is closely tied to a few overarching global trends. Chief among them is the trajectory of U.S. monetary policy, which continues to dominate capital flows worldwide. If the Fed delays its pivot toward lower rates, emerging market currencies like the Rupiah may remain under pressure. Meanwhile, global oil prices — another key input for Indonesia — could either support or complicate the IDR outlook, depending on supply dynamics. Tensions in global trade routes, conflict zones, and the broader investment climate are also critical watch points. Even if Indonesia’s economy holds up well, a shift in global sentiment could lead to knee-jerk reactions in currency markets.

How Does the Rupiah Compare to Other EM Currencies?

In the context of the emerging market currencies outlook 2025, the Rupiah is viewed as moderately stable — not immune to shocks, but backed by a relatively credible central bank and a large domestic economy. While more volatile currencies may see sharper swings, the IDR tends to move in tighter bands unless triggered by external shocks. That said, it’s often grouped into broader EM risk baskets by global investors, meaning contagion from events in other regions (like Latin America or Eastern Europe) can affect Indonesia even without a direct link. That’s why local fundamentals alone aren’t enough — sentiment toward emerging markets as a whole will shape the broader trajectory.

Is There a Strategic Way to Approach Rupiah Exposure in 2025?

For investors or businesses with exposure to the IDR, having a well-considered approach to 2025 will be key. The best strategy for Rupiah investment 2025 may involve currency hedging for those with cost-sensitive operations, or diversification across ASEAN markets for those seeking growth. Keeping an eye on political milestones, including possible elections or fiscal policy announcements, is also advisable, as these events can trigger short-term market reactions. It’s equally important to track both the timing and messaging of Bank Indonesia’s monetary policy, as even minor changes can move the IDR. Ultimately, the right strategy depends not just on forecasts, but on the ability to adapt to changing conditions quickly.

Final Thoughts: What Will Define the Rupiah Forecast in 2025?

As we move deeper into the year, the Rupiah forecast 2025 continues to evolve alongside global market conditions. Whether the IDR weakens or finds support will depend on how effectively Indonesia balances domestic strength with external uncertainty. With inflation seemingly under control and moderate growth continuing, there are reasons for measured optimism. However, global shocks remain a real threat, and the Rupiah is unlikely to escape those unscathed. Staying informed — not just on headline data but on policy shifts and market sentiment — may be the most valuable tool investors and observers can use as they navigate the currency landscape this year.