Trading Journal Indonesia: A trading journal is more than just a spreadsheet filled with numbers — it’s a structured tool that traders use to document their trades, decisions, and emotional responses in real time. For many Indonesian traders navigating the complexities of global and local markets, a trading journal offers clarity in an otherwise chaotic environment. It becomes a mirror that reflects both strengths and weaknesses, allowing traders to better understand their habits, track performance, and develop discipline over time.

Whether you’re trading forex, local Indonesian stocks, or cryptocurrencies, journaling offers insight into how you make decisions and what factors influence your success. While trading apps and charts tell you what happened in the market, a journal tells you why you acted the way you did. And that reflection often makes the difference between consistent improvement and repeated mistakes.

Trading Journal Indonesia: How to Build a Trading Journal with Templates

Building a trading journal doesn’t require advanced tools or platforms. Many Indonesian traders begin with basic formats such as Excel, Google Sheets, or even physical notebooks. The key is to create a structure that can be followed consistently. Begin by deciding what you want to track. At minimum, your journal should include the trade date, the asset involved, direction (buy or sell), entry and exit prices, and position size. To deepen your insight, it’s also important to record why you entered the trade, what strategy you used, what the market conditions were like, and how you felt emotionally before, during, and after the trade.

Once you have a structure in place, commit to recording every trade — not just the successful ones. Journaling is most helpful when it captures a complete picture, including your losses and emotional missteps. After each trading session or at the end of the week, take time to reflect on what the data reveals. This process will gradually help you spot patterns, refine your strategies, and manage risk more effectively.

Trading Journal Indonesia: What to Include in a Trading Journal?

Source: Investing.com

A strong trading journal combines both quantitative and qualitative information. While numbers tell the story of performance, the narrative comes from your strategy choices and emotional reactions. In your journal, include core data like the date and time of the trade, the instrument you traded (such as EUR/USD, BTC/IDR, or BBCA.JK), the direction of the trade, entry and exit prices, and the position size. You’ll also want to include technical elements like your stop loss and take profit levels, leverage used, and the type of strategy applied — whether technical analysis, fundamental news-driven, or a mix of both.

Equally important are your observations and emotional state during the trade. Were you confident or hesitant? Did fear or greed influence your timing? After the trade closes, record whether the result was a win or loss, the profit or loss value, and any risk-reward ratio calculations. Your final notes should reflect on what went well, what could’ve been better, and whether you followed your own plan.

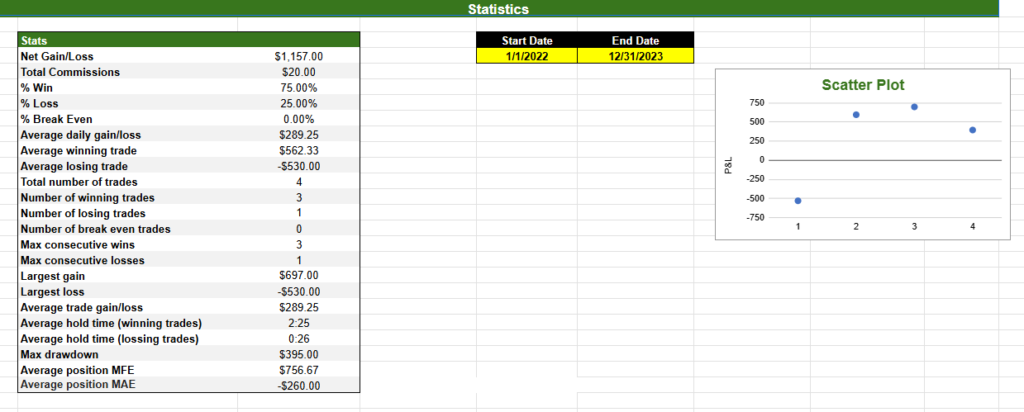

Trading Journal Indonesia: Where to Find Free Trading Journal Templates

Source: FLIPHTML5

For those unsure how to start from scratch, using a ready-made template can be a practical solution. There are a number of free downloadable trading journal templates that work well for Indonesian traders, including those focused on forex, crypto, and equities. For example, forex trading journal templates typically include features like swap tracking, multi-currency support, and pip-based calculations. Simple spreadsheet templates offer a clean layout with basic trade logging fields, suitable for beginners. More advanced versions might include emotional tracking, win-loss visualizations, and formulas for calculating risk-reward ratios.

There are also crypto-specific templates that help you record slippage, exchange fees, and timing differences due to the 24/7 nature of crypto markets. For traders dealing in multiple asset classes — like stocks and futures — multi-market templates provide flexibility. Platforms like Google Sheets are ideal for traders who want cloud access and easy sharing between devices. Ultimately, the best template is one you’ll actually use regularly. Don’t worry about perfection; focus on building the habit.

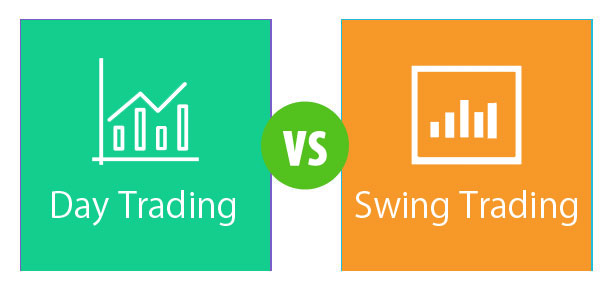

Choosing the Right Journal Format for Your Trading Style

Source: Educba

Not every trader uses the same strategy, so not every journal should look the same. The right journal format depends on your trading style. Day traders who make several trades per day benefit from detailed, real-time entries with precise timestamps and quick emotional reflections. Their journals may also need to track high-frequency indicators like moving averages or news catalysts. In contrast, swing traders and position traders tend to prioritize broader market narratives, such as macroeconomic events, longer technical patterns, or company earnings. Their journal entries may be fewer but more in-depth, often including screenshots of setups or links to relevant news.

Crypto traders in Indonesia — especially those trading around the clock — need to track additional factors like exchange-specific fees, market slippage, and whether trades were influenced by social media or sudden volatility. Visual learners may prefer to embed charts or graphs alongside their notes, while those who like analog methods may use notebooks with printed layouts. The point is to align your journaling style with how you trade. That way, it becomes a natural extension of your trading routine rather than a burden.

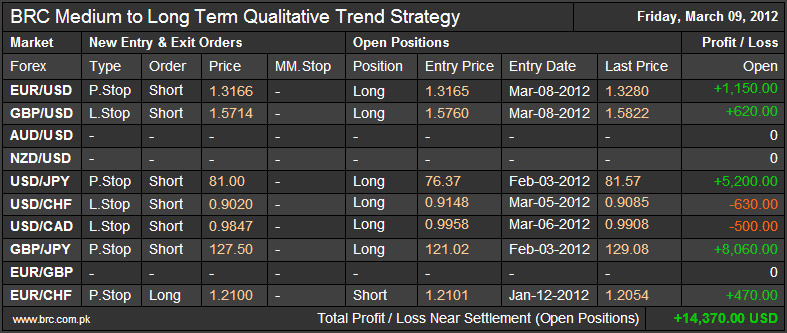

How to Analyze Your Trading Performance Using a Journal

Source: Hubspot

The true value of a trading journal lies not just in collecting data, but in reflecting on it regularly. Once you’ve logged a good number of trades, set aside time each week or month to review your performance. Use your journal to calculate basic metrics like win rate, average return, maximum drawdown, and your best/worst performing strategies. More importantly, evaluate the emotional side of trading. Were most of your losses tied to breaking your rules? Did you overtrade during high-stress periods? Did you let profits run when your confidence was high?

You can ask yourself key questions such as: Did I follow my trading plan today? Was I emotionally prepared for this session? Did I stick to proper risk management? These reflections give your data meaning and turn your journal into a learning tool rather than just a record-keeping log. Over time, you’ll gain a deeper understanding of what leads to success and what causes setbacks in your trading behavior.

Enhancing Your Journal with FlipHTML5 and Digital Tools

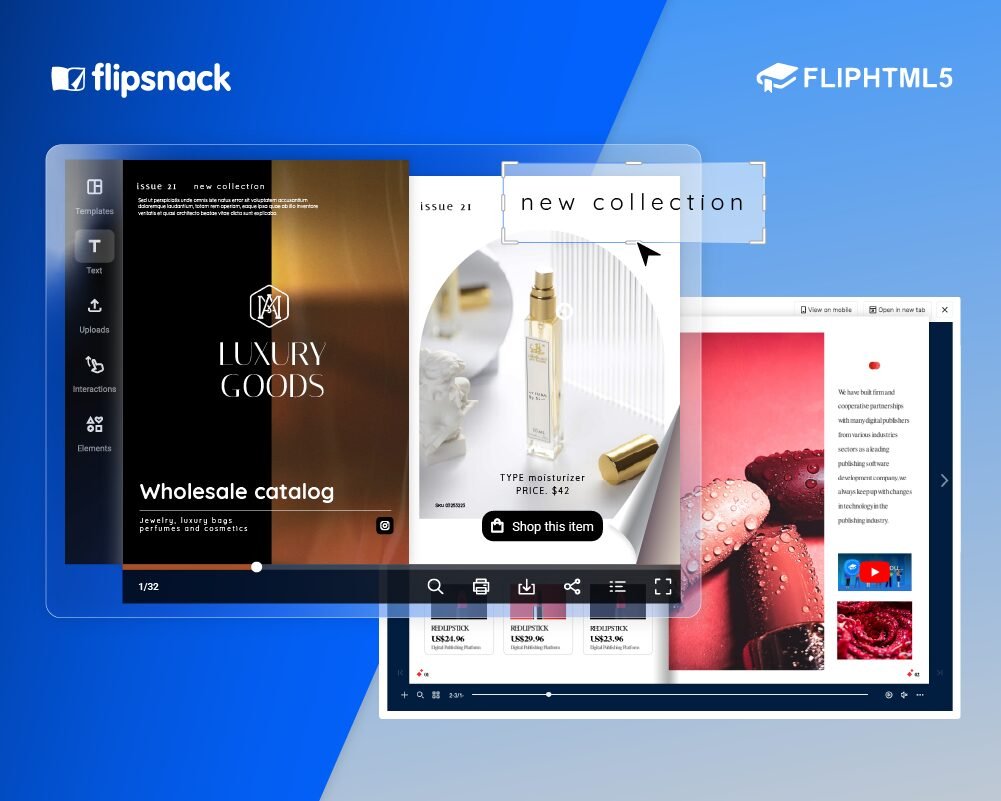

Source: Flipsnack

While Excel and Sheets are powerful, some traders want a more polished or interactive way to manage their journal. FlipHTML5 is one such tool that allows you to convert static journals into dynamic, digital documents. For Indonesian traders who want to keep an archive of their growth or present their portfolio visually, FlipHTML5 offers a creative way to digitize your journal entries. You can upload spreadsheets, charts, or PDFs and turn them into interactive flipbooks.

This format lets you add visuals, videos, and even voice notes, which can help bring context to your trading story. It’s especially helpful if you want to review trades with a mentor or build a personal case study of your trading development. Some traders also use FlipHTML5 AI features to auto-format journal entries and generate layouts that are both aesthetic and functional.

Why a Trading Journal Is Especially Important in Crypto

Crypto markets operate differently from traditional financial markets — they are open 24/7, prone to extreme volatility, and heavily influenced by sentiment. For Indonesian crypto traders, having a dedicated crypto trading journal is crucial for tracking not just trades, but the context around them. You’ll want to record what coin was traded, the type of market (spot or futures), slippage, gas fees (especially when using DeFi), and whether your decision was based on chart analysis or external hype.

Crypto traders often get swept up in FOMO or trade too reactively. A journal brings discipline into this environment. It helps you understand when your decisions were strategic and when they were impulsive. Over time, this awareness allows you to develop a more resilient approach to crypto trading, regardless of market mood.

Final Thoughts: Why Every Indonesian Trader Should Journal

At the end of the day, a trading journal Indonesia is not just a helpful tool — it’s a necessary one. In a market that rewards focus and discipline, journaling gives you a clear edge. It creates a feedback loop where you can continuously reflect, learn, and adjust. You don’t need the most advanced template or the latest software. Start simple. Be honest with yourself. Commit to tracking both your successes and your failures. With consistent use, your journal will become one of your most powerful trading allies — helping you understand not just the market, but your own behavior within it.