Trading Mistakes Beginners Indonesia: For many Indonesians stepping into forex and crypto trading, the appeal lies in high returns, round-the-clock markets, and the ease of accessing global exchanges. But behind the excitement, this fast-paced world comes with equally high risks. The reality is, without a solid plan and emotional control, traders—especially beginners—often find themselves repeating the same costly mistakes.

The phrase trading mistakes beginners Indonesia isn’t just a search query; it reflects a widespread pattern where many new traders jump in unprepared, overlook risk, and end up losing more than they bargained for. This guide explores the most frequent pitfalls in forex and crypto trading, and how beginners can recover, learn, and trade smarter.

Trading Mistakes Beginners Indonesia: The Most Common Trading Mistakes Beginners Make

Source: JAVA

One of the biggest missteps new traders make is diving into live trading without any preparation. Many begin with real capital before testing strategies in a demo environment. They’re drawn in by market movements, social media hype, or friends’ success stories, and they skip the foundational learning phase. But trading without understanding price action, order types, or market conditions is like driving blind.

Another mistake is starting with a large sum of money. While it might seem like a confident move, using large capital early on increases emotional pressure. When the stakes are high, every pip feels amplified—and that leads to impulsive decisions. Using smaller capital not only reduces risk, but also helps beginners stay calm, observe the market, and develop good habits.

A third and very common oversight is ignoring the need for a trading plan. A plan outlines when to enter and exit, how much to risk, and what the goals are. Without it, every trade becomes a guess. This lack of direction often leads to overtrading or revenge trades when losses occur. Emotional instability quickly takes over when logic is absent from the decision-making process.

Discipline is another weak spot for many traders. It’s easy to overtrade when a chart looks “active,” or to chase a loss out of frustration. But consistent results require the opposite: patience, system adherence, and knowing when not to trade. Equally crucial is risk management—yet many traders ignore it entirely. Entering a position without a stop-loss or risking half your account on one trade often ends in disaster.

Protecting the trading account is part of staying in the game. Many don’t realize the value of setting a daily maximum loss limit or using trailing stops to lock in gains. Others overuse leverage, unaware of how quickly it can trigger a margin call. In forex and crypto, even one poorly managed position can wipe out a week’s worth of good decisions.

Trading Psychology: Trading Mistakes Beginners Indonesia- Why Emotions Matter More Than Strategy

Source: Harian Disway

It’s often said that trading is 80% psychology and only 20% strategy—and that statement rings especially true for beginners. Fear, greed, and FOMO (fear of missing out) are emotional forces that influence nearly every trader at some point. The problem is, many new traders are unaware of how these emotions shape their behavior.

Fear can cause you to exit winning trades too early. Greed leads you to hold onto losing ones too long. FOMO drives trades that lack logic. And denial—the refusal to admit a bad trade—can lead to deeper losses. One of the most dangerous scenarios is trading with borrowed money or “hot money” you can’t afford to lose. In these cases, pressure and panic usually override reason.

Mastering your mindset isn’t easy, but it’s necessary. Recognizing your emotional triggers, taking breaks, and using tools like journaling can create awareness and reduce impulsive behavior. Emotional trading mistakes in forex and crypto markets are often the root cause of avoidable losses—more than bad analysis or missed signals.

Trading Mistakes Beginners Indonesia: What to Do After a Big Loss

At some point, every trader faces a significant loss. What happens next matters more than the loss itself. The first step is to accept full responsibility. Blaming the market or external conditions won’t improve your future trades. Instead, revisit the trade history, analyze the setup, and reflect on your emotional state at the time.

Taking a break is often the healthiest next move. Trading under emotional stress leads to more errors, and “tilt”—a term borrowed from poker—can destroy an account in a matter of hours. Giving yourself time away from the screen helps reset your focus and reduce emotional bias.

Once you’ve stepped back, start rebuilding slowly. Revisit demo trading or take smaller trades to regain rhythm and rebuild confidence. The idea isn’t to recover losses instantly—it’s to return to form. Rebuilding with small capital allows you to refine your execution without significant financial pressure.

Risk management also deserves extra attention after a loss. This is the time to double down on what keeps your capital safe: strict stop-losses, proper position sizing, and diversified exposure. Big losses are painful, but they’re also powerful teachers—if you’re willing to learn from them.

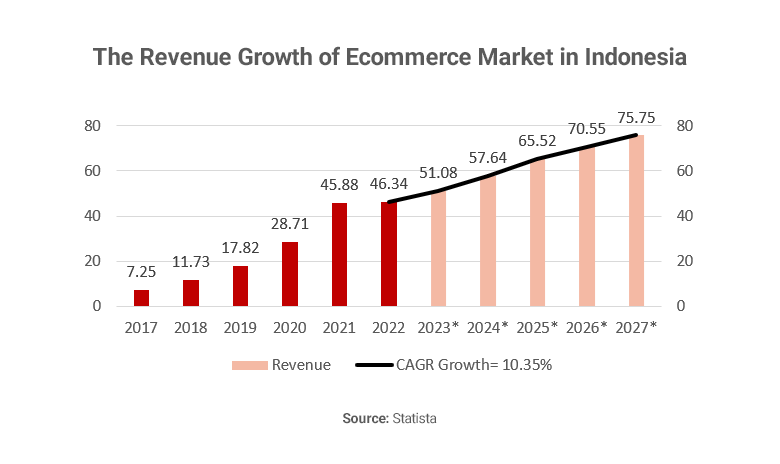

Strategy and Planning in Forex and Crypto Trading

Source: ARC Group

No matter the asset—currency pairs or crypto coins—a clear, tested strategy is your foundation. Education is not a one-time effort but a continuous process. Markets evolve, influenced by global events, policy changes, and technology. Staying updated on macroeconomic news, central bank moves, and industry innovations can sharpen your edge.

Choosing the right broker or exchange is also part of the strategy. Indonesian traders should verify whether a broker is licensed under Bappebti or globally recognized bodies like the FCA, ASIC, or NFA. Unregulated platforms often promise high returns or bonuses but may come with hidden risks like manipulation, frozen withdrawals, or lack of customer protection.

For crypto-specific strategies, beginners often wonder whether to hold long-term (HODL) or trade actively. Both approaches carry risk and require planning. Long-term holding works best with research-backed projects, while active trading suits those who understand technical patterns and risk management. Diversifying your portfolio across different coins, including passive income tools like staking, can help reduce overall volatility.

Both forex and crypto traders benefit from using a mix of technical and fundamental analysis. Understanding candlestick patterns, support/resistance levels, and trendlines helps refine timing, while reading whitepapers or economic reports provides context to price movements. Combining both lenses creates a well-rounded approach.

Crypto Trading Mistakes Beginners Should Be Aware Of

Source: CNBC

Crypto trading comes with its own unique risks. Many beginners invest in coins without understanding the technology or purpose behind them. This lack of research can lead to heavy losses—especially when the project turns out to be a pump-and-dump scheme or fails to gain adoption.

Overtrading is another common issue, particularly during bull runs. When prices rise rapidly, traders tend to chase momentum, often entering at the top. Emotions run high, and logic takes a backseat. It’s important to stay grounded, use limit orders, and assess whether a coin has lasting value or just short-term hype.

Wallet security is also a major concern. Beginners often leave funds on exchanges without setting up proper two-factor authentication or understanding the use of private keys. Hacks, phishing attacks, or even forgetting login credentials can lead to irreversible loss. Learning how to use cold storage or reputable hardware wallets is just as important as understanding price charts.

Conclusion: Build Smarter Habits, Avoid Repeat Mistakes

No trader starts perfectly. Losses, missed opportunities, and bad decisions are part of the journey—but they don’t have to define your future. By developing a solid plan, sticking to disciplined risk management, and becoming emotionally aware, beginner traders in Indonesia can avoid many of the mistakes that trap others.

The trading mistakes beginners Indonesia face aren’t unique—but they are avoidable. The key lies in preparation, humility, and consistency. Whether you trade forex or crypto, your biggest assets are not your capital or your tools—they’re your mindset, your plan, and your ability to stay calm under pressure. Focus on what you can control, and the results will follow.