Trading psychology Indonesia: Trading psychology refers to the mental and emotional aspects that influence a trader’s decision-making. In Indonesia, where beginner traders are growing in number—especially in forex, crypto, and stock trading—the ability to control emotions can be just as crucial as market analysis. Terms like psikologi trading and emosi dalam trading have become increasingly relevant as more people enter the market without first preparing their mindset.

The Role of Discipline and Structure

Discipline forms the backbone of good trading habits. It begins with a clear trading plan that outlines your entry and exit strategies, profit targets, and acceptable risk. Many Indonesian traders jump in without a plan, relying on gut feeling or signals from others. But structured trading helps reduce impulsive actions and emotional reactions. Following your own method consistently—even during a losing streak—builds long-term sustainability.

Emotional Control and Self-Awareness

Source: Stock cake

Fear and greed are two of the strongest emotional forces in trading. Fear can cause hesitation or panic selling, while greed often leads to overtrading or chasing unrealistic gains. Emotional self-control means not reacting impulsively. In the Indonesian context, where sudden news or price movements can stir public reaction, traders must learn to stay calm and analyze instead of following emotional impulses. Recognizing emotions early allows you to pause and refocus.

Avoiding the Most Common Mental Traps

Several psychological traps often lead to losses:

FOMO (Fear of Missing Out) is especially common. You see a trend moving fast and feel compelled to jump in without proper analysis.

Revenge trading is another issue—making impulsive trades to make up for previous losses, often worsening the situation.

Overtrading happens when you feel the need to always be in the market, even without a clear signal.

Gambler’s fallacy convinces you that a win is “due” after many losses, while herd mentality pushes you to copy trades without doing your own analysis.

Being aware of these patterns is the first step to avoiding them.

Tools to Improve Your Trading Psychology

Source: Trading with Rayner

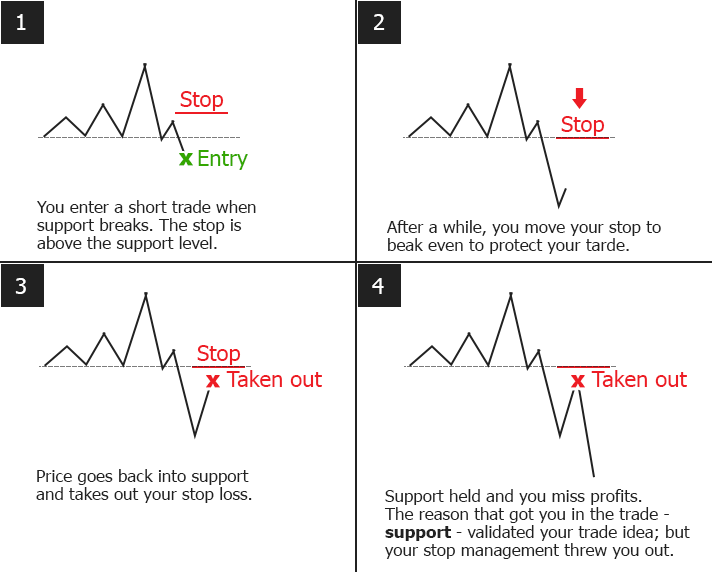

You can strengthen your trading mindset with simple, consistent practices. Start by maintaining a trading journal—not just to track trades but to record emotional states and thoughts before, during, and after each trade. This helps identify patterns over time.

Another helpful tool is using stop-loss and take-profit orders. These not only automate part of your strategy but also act as a safety net when emotions take over. It’s easier to be disciplined when your plan is already in place.

The 3M Framework: Mind, Method, Money

Source: SynapseTrading

The 3M approach is a foundational concept in trading psychology:

- Mind represents your emotional state, self-control, and mental preparedness.

- Method is the strategy you use, which should be tested, consistent, and tailored to your personality.

- Money refers to capital management and risk control.

Balancing these three keeps your trading holistic and less prone to emotional errors. In Indonesia’s dynamic market environment, traders who focus only on profit often neglect the mental and strategic foundation needed for long-term consistency.

Trading psychology Indonesia: The Importance of Breaks and Reflection

Source: Radecity

Successful traders know when to step away. After a winning streak or a series of losses, your emotional state becomes more vulnerable. Taking breaks—whether for a few hours or a few days—can reset your mindset and prevent burnout. It also provides space for critical reflection, allowing you to re-enter the market with clarity instead of emotional baggage.

Trading psychology Indonesia: When to Trust Intuition (And When Not To)

Many new traders confuse emotional impulses with intuition. Real intuition in trading comes from experience—when your brain recognizes patterns subconsciously. But if you’re new to trading, that “gut feeling” may simply be wishful thinking or fear. Trust your plan and data first. Let intuition be a secondary filter that enhances your decision—not the main driver behind your trades.

Conclusion: Trading psychology Indonesia- Why Trading Psychology Indonesia Matters

In the end, mastering trading psychology Indonesia isn’t about being perfect. It’s about being aware of your emotions, learning from your reactions, and constantly adjusting your approach. Many traders focus too much on strategies and indicators, forgetting that mindset is the foundation of every decision. By developing discipline, emotional awareness, and structured habits, Indonesian traders can build the resilience needed for long-term success in the financial markets. Remember—consistency begins in the mind, not just on the chart.