Let’s be honest—crypto can be both exciting and confusing at the same time. It moves fast, feels a bit like the wild west, and yes, there’s a lot of risk involved. But beyond just price swings, there’s another important issue many miss: common crypto traps. These traps aren’t just rookie errors—experienced traders have fallen victim too, and knowing about them can really save your assets.

Understanding these traps isn’t about fear—it’s about being informed. These risks can drain your wallet, damage your reputation, and leave you scratching your head wondering what went wrong. Whether you’re new to crypto or a seasoned participant, it pays to be aware.

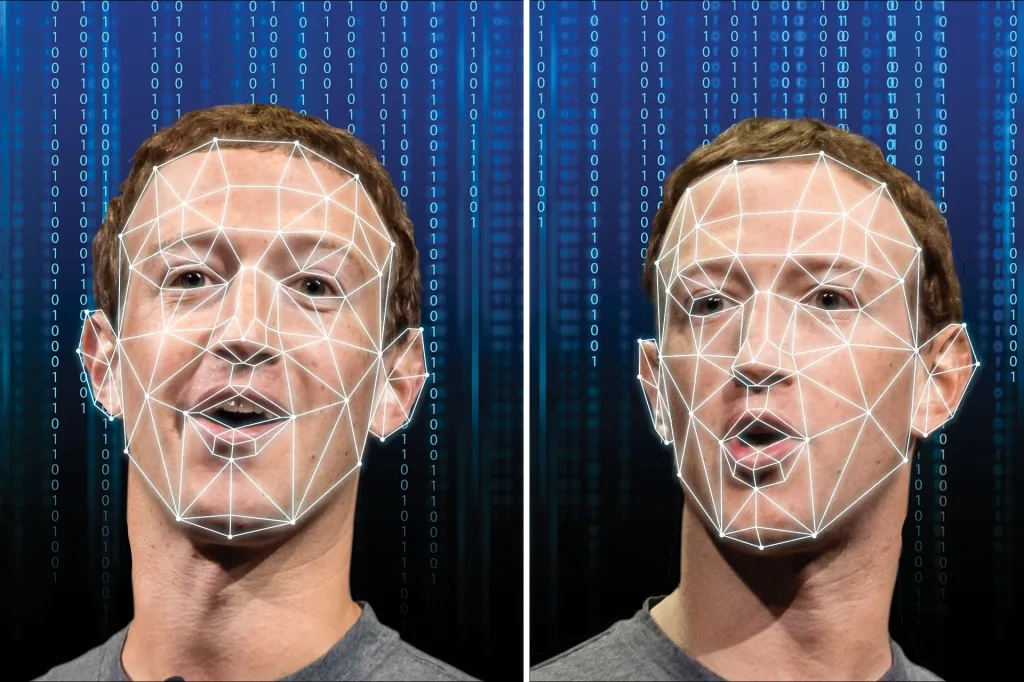

Common Crypto Traps: Recognizing Fake Celebrity Endorsements

You may have seen posts online claiming that big names like Elon Musk are endorsing a new cryptocurrency. Here’s the truth: most of these claims are false. Scammers often use deepfake videos or hacked social accounts to promote fake coins. This tactic tricks many into investing quickly without verifying facts.

The best approach? Always verify the source, and if something feels rushed or suspicious, slow down and research before acting.

Rug Pulls: How to Spot When a Project Disappears

Rug pulls are a frequent crypto scam where developers launch a project, hype it heavily, then disappear with investor funds. The website and whitepaper may look professional, but once the liquidity dries up, the token’s value plummets to zero.

This is especially common in decentralized finance (DeFi), where anyone can create tokens in minutes. To avoid this trap, look for transparent teams and verified liquidity locks.

Common Crypto Traps: Ponzi Schemes Disguised as Passive Income Opportunities

You might come across platforms promising very high daily returns for staking or lending your crypto. While some legitimate platforms exist, many of these offers are Ponzi schemes that pay old investors with money from new ones.

These inevitably collapse, leaving late investors with losses. Always question if the promised returns sound too good to be true — because often, they are.

Phishing Scams: Staying Alert to Protect Your Wallet

Phishing is a quieter but highly effective scam. You could receive an email or message pretending to be your wallet provider or support team, asking you to share private keys or passwords. Genuine companies never ask for this info directly. Protect yourself by verifying URLs carefully, never sharing private keys, and avoiding unsolicited messages requesting sensitive data.

Impersonation Tokens: How to Verify What You’re Buying

Some tokens are designed to look just like major cryptocurrencies, copying logos, names, and even ticker symbols. These imposters trick users into buying worthless tokens by mistake. The key defense here is to always double-check the exact token contract address before making a transaction — don’t rely on just the name or logo.

“Guaranteed Profit” Trading Bots: What You Need to Know

Automated trading bots can be useful tools, but be cautious. Many bots promising unrealistically high returns are outright scams. If a bot guarantees you 300% profits, that’s a huge red flag. Never send funds to a bot or service that promises guaranteed gains — crypto markets are volatile, and no one can guarantee profits.

Beware of Fake Wallet Apps

Downloading wallet apps from unofficial sources can lead to stolen funds. Some malicious apps mimic trusted wallets perfectly, then steal your private keys once you enter them. To stay safe, always download wallet apps from official websites or verified app stores.

Airdrop Scams: How to Spot Legitimate Offers

“Claim your free tokens!” sounds tempting, but beware. Some airdrops ask you to connect your wallet to unsafe contracts or request personal info that can be misused. Remember, legitimate airdrops will never ask for your private keys. When in doubt, research the project’s official channels.

Common Crypto Traps: FOMO-Driven Pump and Dumps

When a coin suddenly spikes 500% or more, it’s often a pump-and-dump scheme. Early investors push the price up, then sell off quickly, leaving latecomers with losses. This is a classic emotional trap exploiting fear of missing out (FOMO). The lesson? Don’t rush into hype without solid research.

Unverified Smart Contracts: Why Caution Matters

Interacting with unverified or unaudited smart contracts can be dangerous. Malicious contracts may allow hackers to drain your wallet or approve transactions without your consent. If you don’t understand a contract fully, it’s best to avoid using it.

Final Thoughts: Knowledge Is Your Best Defense Against Common Crypto Traps

Ultimately, investing in crypto means taking control of your financial future—but with that comes responsibility. There are no banks to call for help or ways to reverse transactions once lost. These common crypto traps evolve quickly, but staying informed and cautious is your best protection.

Maybe it sounds obvious, but if something in crypto seems too good to be true, it probably is. Educate yourself, double-check everything, and approach new opportunities with a healthy dose of skepticism.

Relevant news: here